Greater Denver Metro Real Estate Market November Trends Report Gives Buyers and Sellers A Reason For Gratitude This Holiday Season

In a year of continued turbulence, October represented a month of relative ease in the bumpy Denver real estate market, signaling gratitude across the housing industry. Across the board, the majority of statistics were seasonally consistent with what Denver has seen in years past, boding well for more households having the ability to host a Thanksgiving dinner. With prices staying consistent month-over-month, the door has opened for buyers that were previously exhibiting burnout in the home search process.

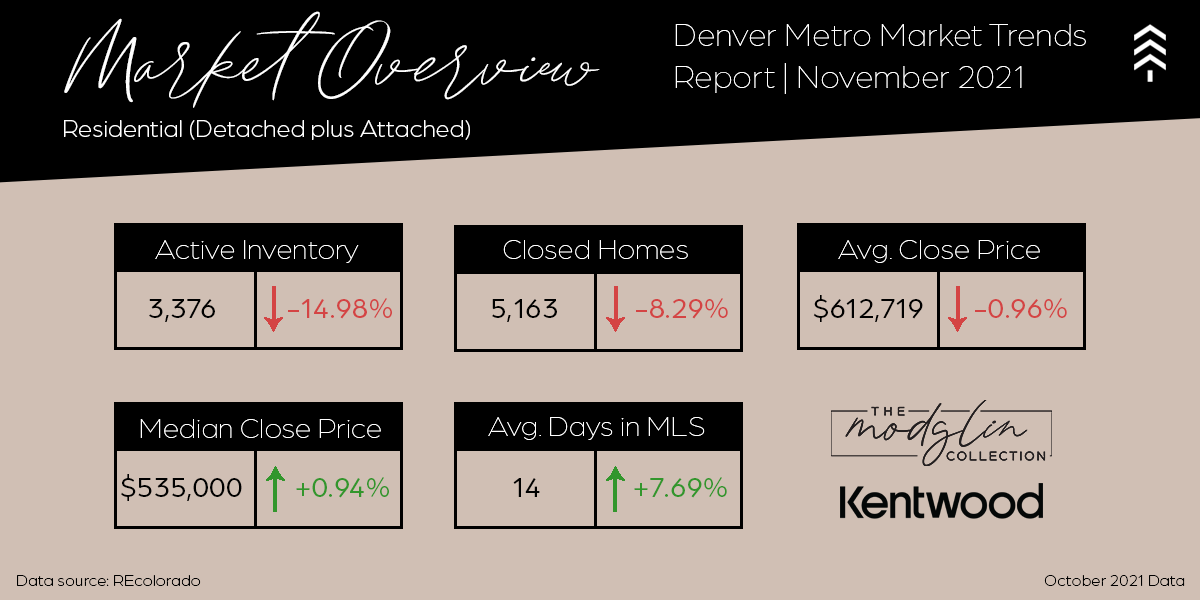

In the month-end active inventory, Denver saw that when lower numbers change, they yield higher percentages. At the end of October, there were 3,376 properties on the market, a 14.98 percent decrease from the previous month. The amount of listings also decreased by 13.28 percent, showing minimal changes in the month-end inventory.

There were over three times more single-family properties closed last month in the $500,000-$750,000 category than any other price point. However, currently there are more single-family detached properties available over $1 million than any other price point, which is far less surprising than the quantity of for sale properties between $500,000-$750,000.

The DMAR Market Trends Committee releases reports monthly, highlighting important trends and market activity emerging across the Denver metropolitan area. Reports include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson and Park counties. Data for the report was sourced from REcolorado® (November 3, 2021) and interpreted by DMAR.