April 2021 in the Greater Denver Metro housing market showed that the blatant hyper-demand in the residential housing industry continues to result in historic low months end inventory, even with months-end active inventory increasing by 35.03 percent. Altogether, there were still only 2,594 active properties at the end of the month, representing the lowest April on record and 48.38 percent less inventory than the previous April low in 2015.

As one reflects on this month's market trends report, it is important to remember where the market was this time last year. April 2020 was a month of confusion, fear and uncertainty for the world. The ebbs and flow of being an “essential” worker were reflected in new listings last year, which were down 43.02 percent compared to April of this year.

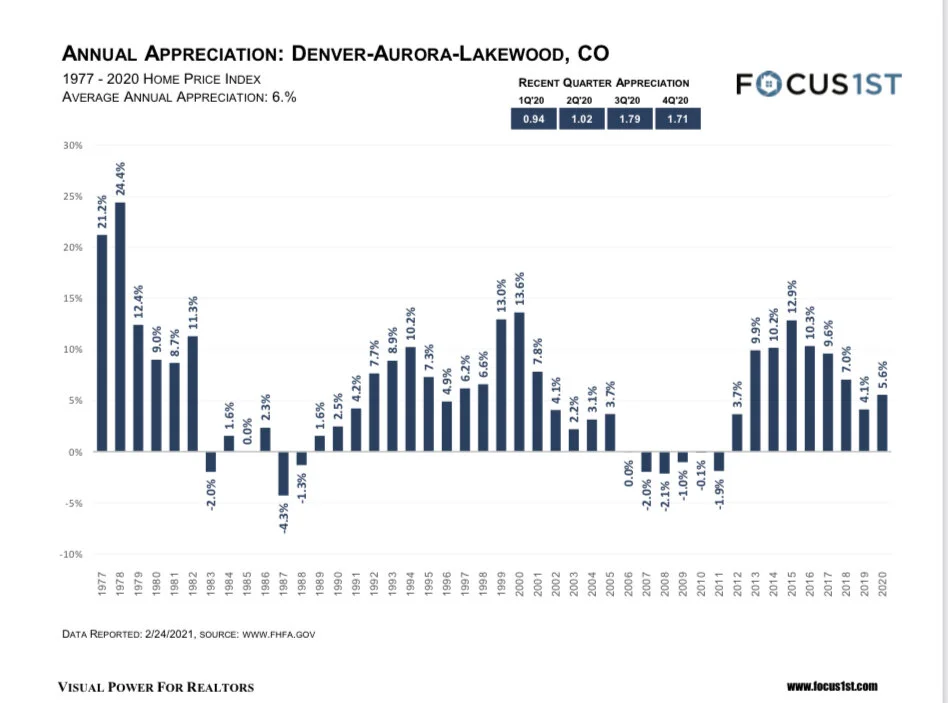

Since last year, the market has seen a steady rise in competition and therefore prices have as well. With only two weeks of inventory, year-over-year appreciation continues to be both staggering for the market while also bringing home sellers inevitably great returns, increasing 24.20 percent in April.

“This April, the attached market saw a month-over-month appreciation of 7.30 percent, while the detached market saw an increase of 4.28 percent,” said Andrew Abrams, Chair of the DMAR Market Trends Committee and Metro Denver REALTOR®. “The explanation for these statistics could be as simple as the attached market has a more approachable price point. The average purchase price of a single-family detached property in the Greater Denver Metro area is $699,039. With prices on the rise, education, strategy and expectations have never been more critical for a buyer approaching this market.”

Our monthly report also includes statistics and analyses in its supplemental “Luxury Market Report” (properties sold for $1 million or greater), “Signature Market Report” (properties sold between $750,000 and $999,999), “Premier Market Report” (properties sold between $500,000 and $749,999), and “Classic Market” (properties sold between $300,000 and $499,999).

April showed no signs of slowing down in the Luxury Market with some interesting trends at hand. Overall, the Luxury Market has experienced more growth than any other segment. In 2018, 2019 and 2020, year-to-date closed sales of properties over $1 million were 649, 654 and 661, respectively. So far, in 2021, there have been 1,353 closed sales, more than double the number of the past three years. The median days in MLS for the Luxury Market was seven, down from 23 in 2020, 22 in 2019, 32 in 2018 and 48 in 2017.

Luxury Market closed sales in April 2020 were contracted before the shutdown, and on average, sold for 97.61 percent of list price. This April, buyer demand has pushed that number to 102.43 percent of list price, nearly five percent more than last year showing not an inventory crisis but a hyper-demand that has increased the speed at which the market operates and the prices that homes transact.

“Year-over-year data for April 2021 is difficult to reconcile for the Luxury Market given the numbers last year as the pandemic raged,” said Taylor Wilson, DMAR Market Trends Committee member and metro Denver REALTOR®. “What we do know is that the Luxury Market is changing, and those who pivot quickly will capitalize on the opportunities that still exist: low interest rates, a strong economy and a low price to build a home. Fast, aggressive offers with strong financing will continue to be the path to success in the Luxury Market.”

Historically, the market has seen annual inventory reach its low point in February and March, followed by increased listing activity until we hit our inventory peak in August and September. The Luxury Market appears to follow the trend with 28.82 percent more new listings in April than March, showing that it may be possible for buyers who outlast the fatigue of competition to find themselves with more options than they have seen in the past few months. If so, with only one month of inventory for attached homes and 1.97 months for attached homes, buyers will need to keep their feet on the gas to win.

The DMAR Market Trends Committee releases reports monthly, highlighting important trends and market activity emerging across the Denver metropolitan area. Reports include data for Adams, Arapahoe, Boulder, Broomfield, Clear Creek, Denver, Douglas, Elbert, Gilpin, Jefferson and Park counties. Data for the report was sourced from REcolorado® (April 1, 2021) and interpreted by DMAR.